Local Market Expertise, Proven Performance, Trusted Partner

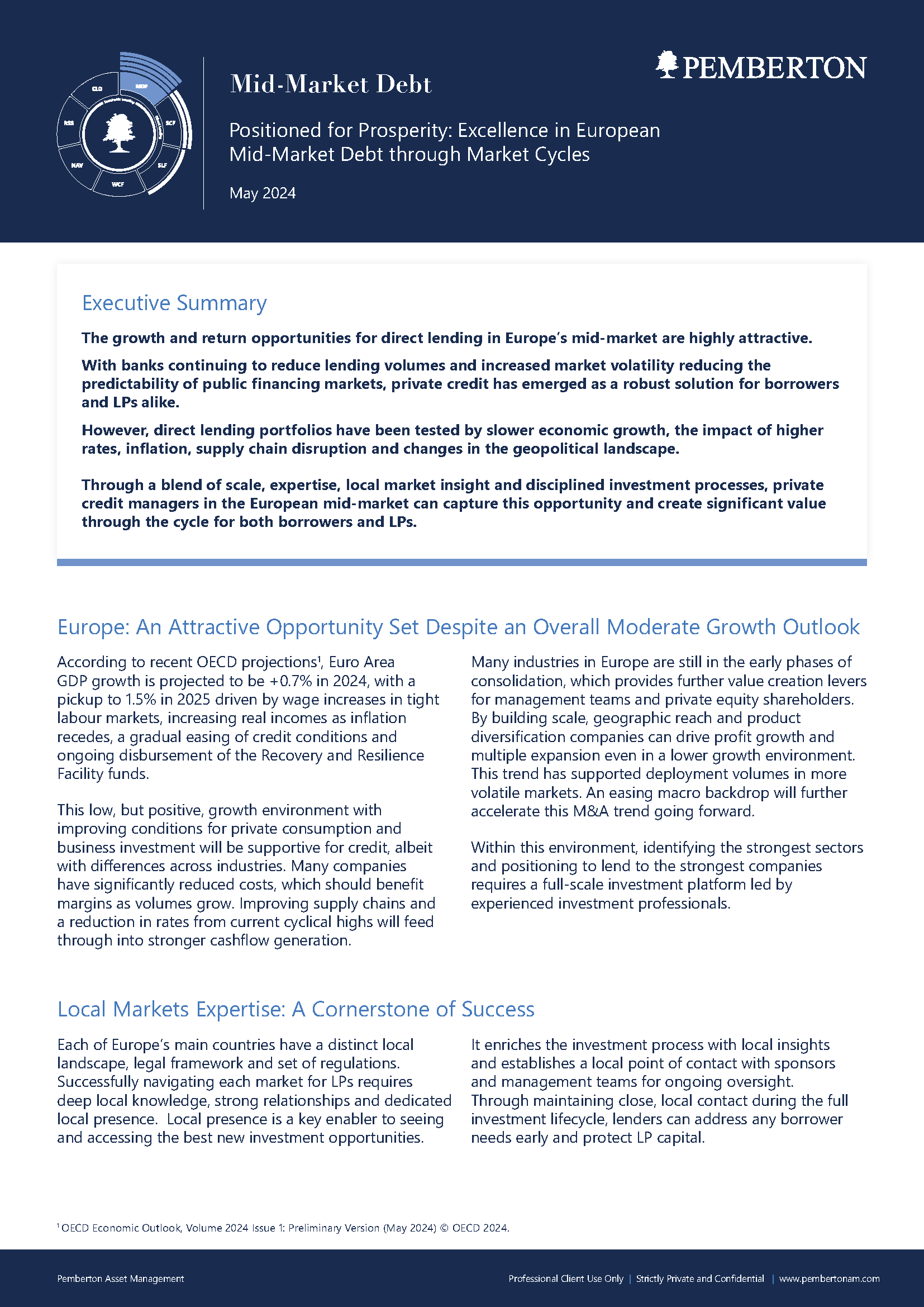

Mid-Market Debt is Pemberton’s flagship direct lending strategy focused on investments in leading European mid-market companies. Across all MDF fund vintages we have:

€10.4bn

Cumulative capital raised1

€12.8bn

Cumulative capital deployed1,2

100

Companies invested3

About Mid-Market Debt

Accessing the European mid-market opportunity set with Pemberton’s MDF Strategy

Core financing

The strategy focuses on investments in:

- Leading European mid-market companies with:

- Strong credit fundamentals;

- EBITDA typically between €15 million and €75 million;

- Proven management teams and professional shareholders.

- Senior secured loans with:

- First-ranking seniority;

- Financial and operational covenants to limit downside risk;

- Cash coupons to provide a regular income stream.

The strategy primarily focuses on investments in performing companies in defensive industries with characteristics including market-leading positions, strong cash flow generation, experienced management teams, and strong downside/structural protection. Our investments typically also provide companies with capital for growth and acquisitions.

Pemberton is typically the sole or lead lender to our portfolio companies, which allows our deal teams to negotiate bespoke bi-lateral lending agreements. It also allows our deal teams to have regular access to management and financial information that enables us to closely monitor loans post-close.

Investment opportunities are sourced through Pemberton’s local origination teams, which have extensive and long-standing relationships with private equity sponsors, banks and advisors. We also source new opportunities directly from companies and management teams, particularly where we can provide incremental capital to support attractive M&A opportunities for existing portfolio companies.

The strategy is managed by Portfolio Managers, Robert Wartchow and Steven Craig

Meet the team:

In our sector, speed and certainty of execution are key for the success of a buy & build strategy. Pemberton’s understanding of this has been outstanding and dealing with a single like-minded partner for financing proves valuable.

Stijn Nijhuis

CEO of Enreach - 2020

1Source: Pemberton Capital Advisors LLP, April 2024. AUM defined as committed capital since inception.

2Includes recycled capital during the investment period.

3As at April 2024.

Selected recent investments

A portfolio company of

Term Loan & Acquisition Facilities

May 2024

A portfolio company of

Term Loan & Acquisition Facilities

April 2024

An add-on acquisition

Term Loan & Acquisition Facilities

December 2023

A portfolio company of

Term Loan & Acquisition Facilities

July 2023

A portfolio company of

Term Loan & Acquisition Facilities

March 2024

A portfolio company of

Term Loan & Acquisition Facilities

February 2024

An add-on of

Term Loan & Acquisition Facilities

May 2023

A portfolio company of

Term Loan & Acquisition Facilities

April 2023