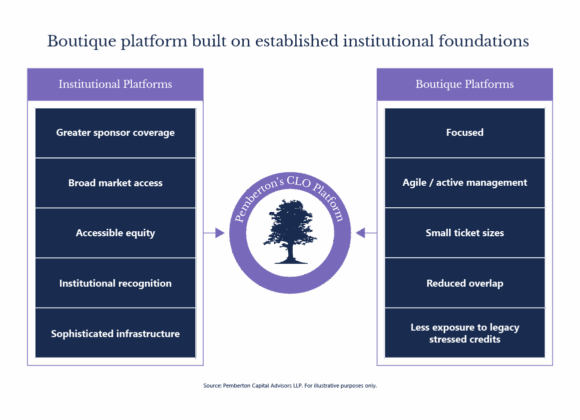

Pemberton Prices and Upsizes €432.1m Indigo III CLO, Marking Continued Growth of its Platform

Pemberton Asset Management (“Pemberton”), one of the leading European private credit managers, announces the successful pricing of Indigo Credit Management III DAC (“Indigo III”), a €432.1m European collateralised loan obligation (“CLO”) transaction.