SCF | Veezu – MML Capital

a portfolio company of

Term Loan & Acquisition Facilities

October 2024

We deliver attractive returns for our clients and provide flexible capital solutions to our borrowers. As responsible stewards of capital, we contribute positively to the economic and social success of the communities we are connected to and provide a working environment where our employees can thrive.

Source: European Commission, Annual Report on European SME’s 2022/23

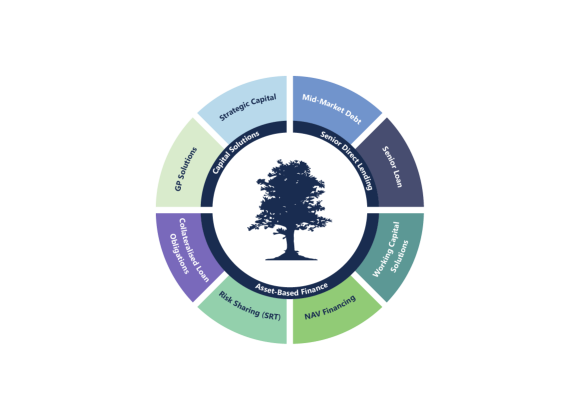

We support our clients’ investment objectives with leading, innovative private credit strategies, leveraging our highly diversified, multi-strategy platform.

Backed by one of Europe’s largest insurers – Legal & General, we provide a range of financing solutions for borrowers and investment solutions for institutional investors.

We have a strong combination of asset management and banking expertise. Our skill lies in our ability to originate, select and manage diverse credit exposure through our local, on-the-ground pan-European origination offices.

Pemberton’s investor base is global and includes long-term partnerships with insurance companies, corporate and public pension funds, sovereign wealth funds, family offices, private wealth managers and other institutional investors.

Many of our Limited Partners have invested across Pemberton’s strategies, either through fund investments or via tailored and innovative structures.

Our network of local offices provides a unique platform to originate, select and manage diverse credit exposure. That makes us an attractive partner for institutional investors searching for better yield and more downside protection than is typically offered by liquid credit instruments.

Pemberton is a relationship-focused firm with a breadth of financing options for financial sponsors. Our platform has the capability to secure financings at both Fund and GP level (against equity holding values), as well as portfolio company level (against assets and cashflows).

Working Capital Solutions

Direct Lending

Collateral Loan Obligations (CLOs)

GP Solutions

NAV Financing

Managing Partner

Partner, Chief Operating Officer

For further information or if you have a specific query, please get in touch.

Contact