Announcement

ADIA anchors Pemberton’s new NAV Financing Strategy

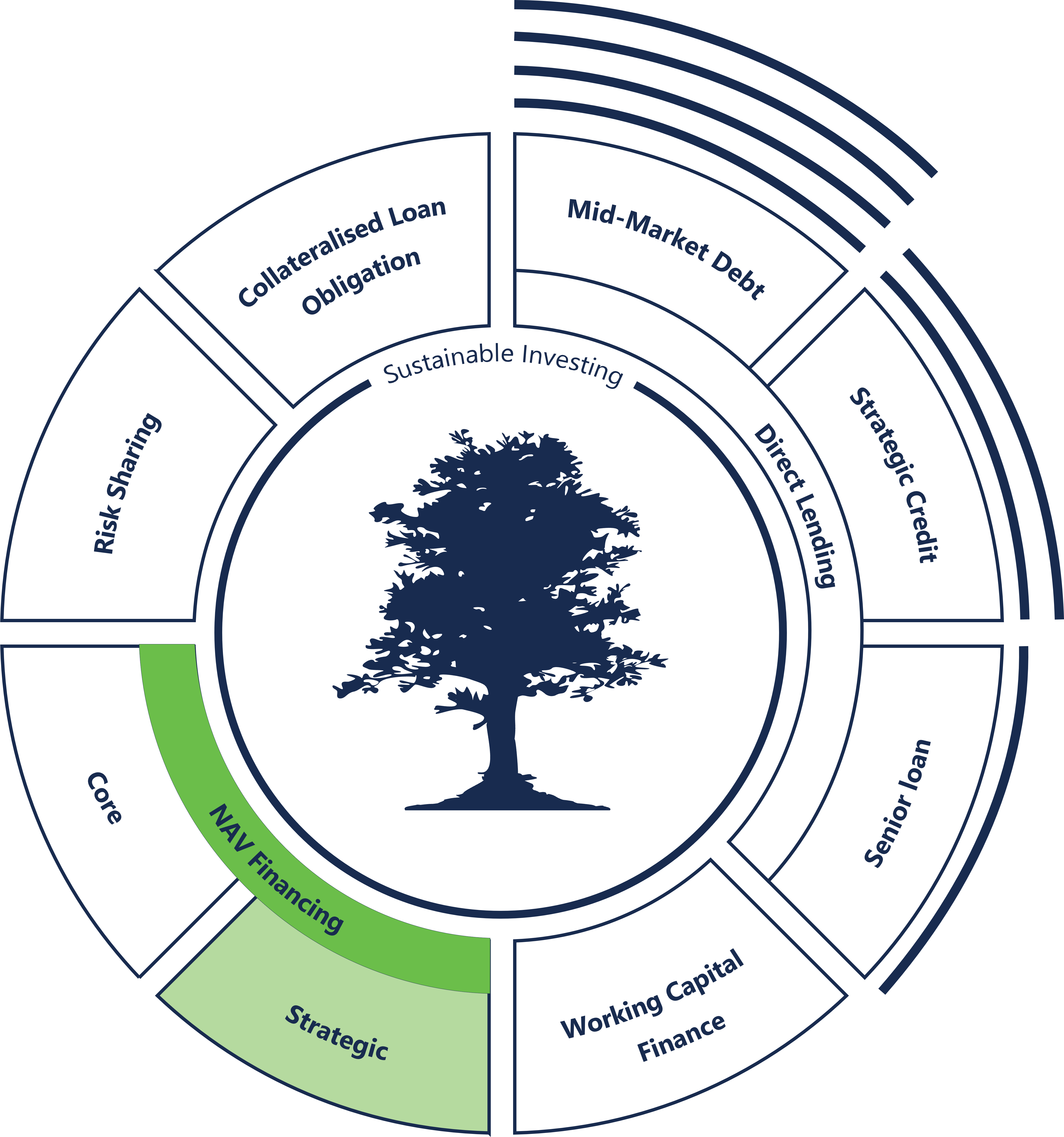

Pemberton Asset Management (“Pemberton”), a leading European private credit manager, today announces that a wholly owned subsidiary of Abu Dhabi Investment Authority (ADIA) has agreed to anchor Pemberton’s new NAV Strategic Financing strategy.

Together with commitments from other investors, ADIA’s investment is expected to result in a first close for the NAV Strategic Financing Strategy in excess of U$1bn in the coming weeks.

NAV Strategic Financing capitalises on the growth of the private equity fund finance market to provide non-dilutive strategic capital solutions to private equity GPs and funds. Pemberton anticipates the strategy will provide GPs with growth capital to support increased fund commitments, succession planning and strategic initiatives, whilst also providing capital for accretive portfolio company investments such as bolt-on acquisitions.

The NAV Strategic Financing Strategy is a natural extension of Pemberton’s market-leading direct lending platform, which currently offers lending solutions for individual assets, and enables Pemberton to offer a broader range of products to its private equity buyout community.

ADIA’s anchor commitment reflects the growing interest in the NAV asset class, the strength of Pemberton’s private credit platform and our ability to deliver a broad range of financing solutions to private equity managers. We believe that NAV financing will become a core fund financing tool and, with ADIA’s support, we look forward to offering this innovative solution to our clients.

– Symon Drake-Brockman, Managing Partner of Pemberton

Pemberton is one of the leading private credit managers in Europe with a highly experienced team and a deep network across the GP community. NAV Financing is one of the fastest growing asset classes in private credit and we are confident Pemberton’s new strategy will prove attractive to a broad range of GPs.

– Hamad Shahwan Aldhaheri, Executive Director of the Private Equities Department at ADIA

This anchor commitment from ADIA is an indicator that NAV Financing is becoming a standalone institutional asset class, which we believe is set to substantially grow over the next years. NAV Financing leverages the proven strength of our broad origination and credit risk management capabilities to provide innovative financing solutions for GPs globally.

– Thomas Doyle, Partner and Head of Strategic Financing at Pemberton

Recent news articles

18th November 2024

Pemberton backs Inflexion’s acquisition of Finanzen.net Group

1st November 2024