Olivier Renault

Managing Director, Head of Risk Sharing Strategy

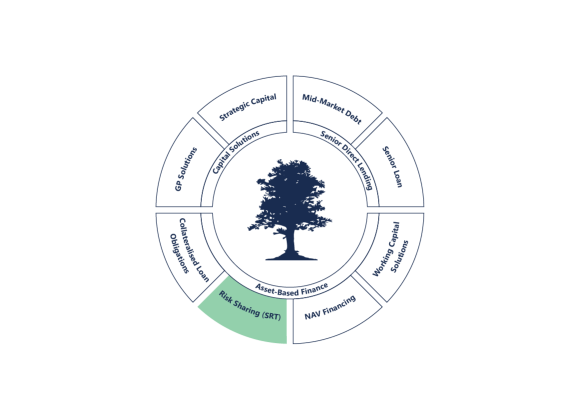

Participation in diversified portfolios of IG corporate or SME loans held on the balance sheet of leading banks. High running coupons and resilient return profile.

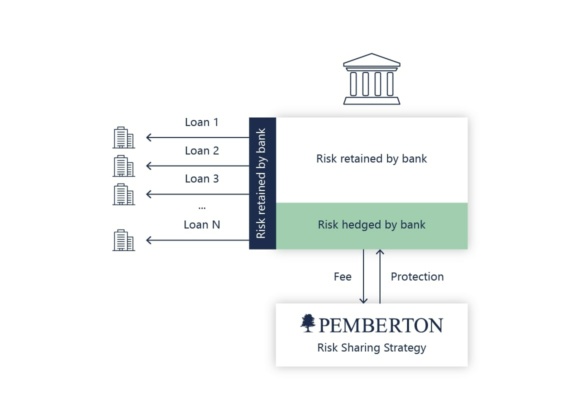

Since the implementation of Basel III banks have looked at ways to maintain or grow their loan portfolios under increasingly constraining capital requirements. Bank risk sharing transactions provide risk and capital relief to banks to continue lending to their clients. The market for risk sharing transactions has grown steadily by over 20%1 per annum since 2010 and we expect it to continue growing due to an increasingly favourable regulatory framework and greater adoption of the technology by banks globally.2

Pemberton’s Risk Sharing Strategy focuses on junior tranches of Risk Sharing transactions. These provide efficient relief to banks while delivering attractive risk-adjusted returns to investors. The asset class benefits from comparatively high diversification (each asset references hundreds or thousands of loans) and from the mismatch between the amount of risk banks need to hedge to obtain capital relief and projected losses in their core loan portfolios.

We believe that Pemberton’s platform combining local origination in 9 European jurisdictions, extensive credit analysis capabilities and expertise in bank capital is well positioned to help investors access this interesting area of private credit.

The strategy is managed by Portfolio Manager Olivier Renault.

Managing Director, Head of Risk Sharing Strategy

Managing Director, Head of Origination, Risk Sharing Strategy

In SRT Volumes: The Road to $200bn, Olivier Renault, Pemberton’s Head of Risk Sharing Strategy, explores key drivers behind the market’s expansion and its path to a potential $200 billion milestone.

The bank balance sheet securitisation market has enjoyed significant growth over the past five years and looks set to continue apace on the back of clearer regulation

In a previous research piece1 we discussed the resilience of the Risk Sharing (SRT2) asset class to credit stress. The majority of investors we speak to acknowledge the attractiveness of Risk Sharing in terms of headline return and stability. One of the most pervasive questions we encounter, however, relates to the relative value of SRTs vis […]

In Pemberton’s most recently published article, Pemberton’s Risk Sharing Team, Olivier Renault and Anna Neri introduce how bank risk sharing transactions have become an increasingly popular tool for banks to hedge their loan portfolios and release capital, while aiming to illustrate the strong resilience of risk sharing transactions to credit stresses. The article further addresses: […]

Click here for an overview of Pemberton’s Strategies:

For further information or if you have a specific query, please get in touch.

Contact