Executive Summary

Yields up, leverage down and volumes of investment opportunities increasing.

As expected, M&A activity picked up in Q4 2023 after a relatively subdued market earlier in the year. In 2024, we expect the volume of activity to be higher than in 2023, while remaining below the pre-rate hike peaks of 2019 and 2021.

In our view, an increasing number of asset sellers have come to terms with lower exit multiple expectations and buyers are using contingent consideration, lower leverage and allowing partial equity rolls to complete deals to deploy their record levels of dry powder.

Key Themes

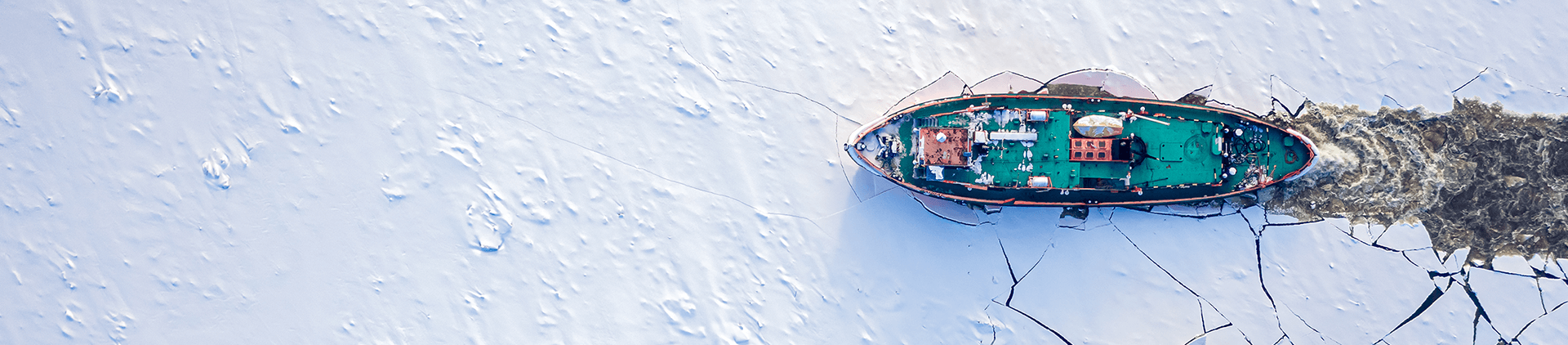

1. Pricing:

Yields remain close to recent highs for direct lending transactions. Looking into 2024, base rates are projected to remain stable with possible tapering action towards the end of the year1. We expect margins to tighten (as seen in Q4 2023) but for all-in yields to remain high and attractive.

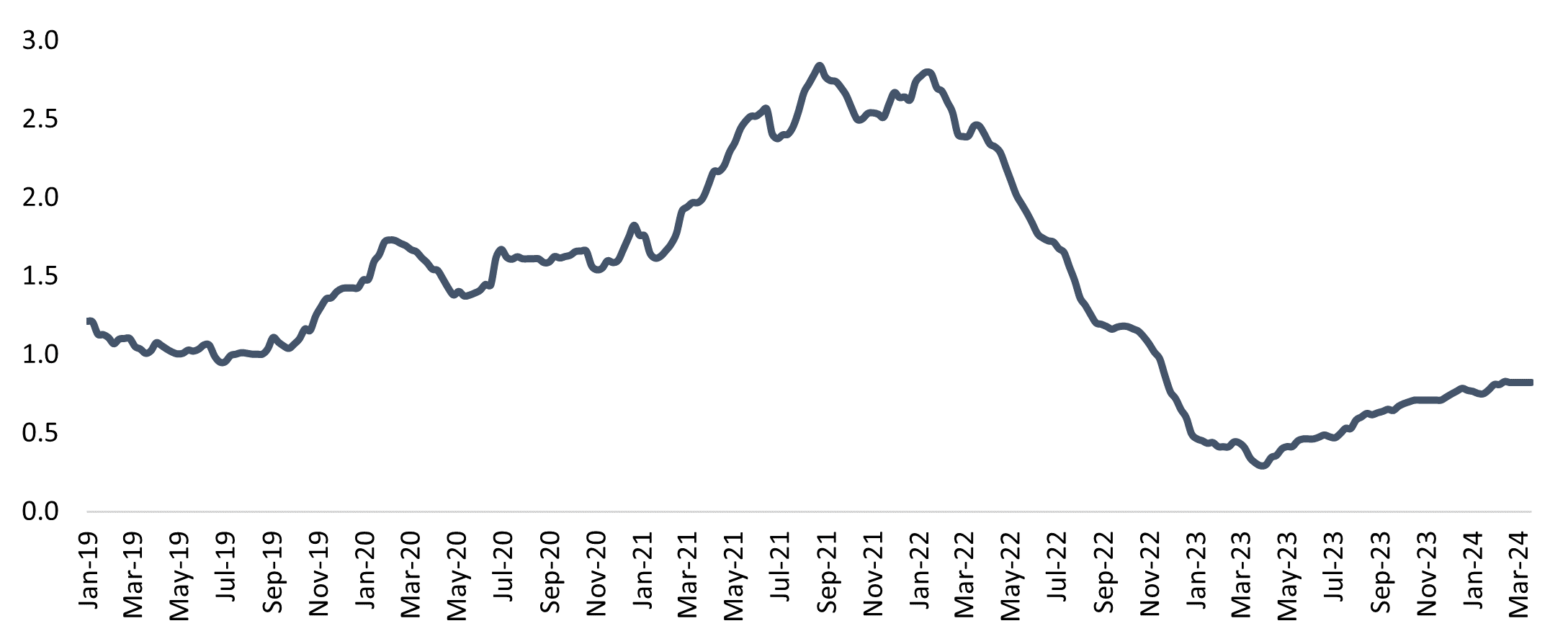

Figure 1: Historic Yield Development based on Pemberton’s Mid-Market Debt Fund (MDF)2

1Source Oxford Economics – Research Briefing as of 15 Nov 2023

2Source: Upfront fees are illustrated based on 3-year repayment basis. Bloomberg as at 10 Jan 2024 (base rates)

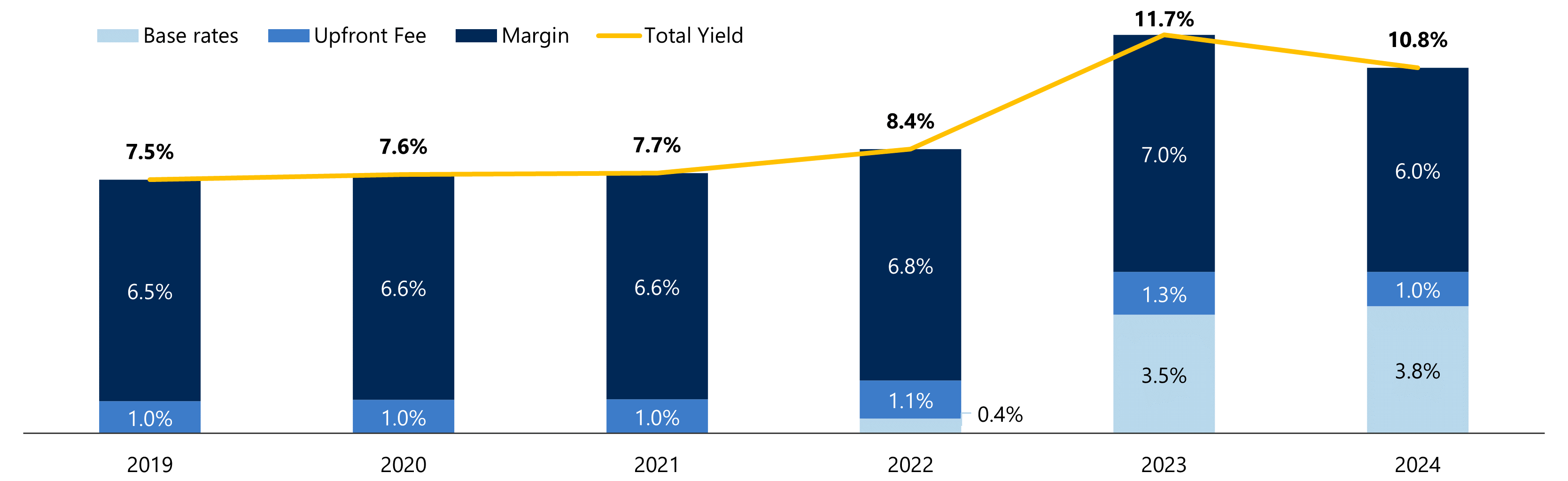

2. Returns and Relative Value:

Direct Lending yields and returns continue to offer significant yield pick-up vs its syndicated counterpart with a premium of ca. 200bps.

Given the rates backdrop, returns in direct lending are set to remain elevated during 2024 and into 2025, with most 1st lien portfolios attracting double-digit gross returns. Volume in subordinated loans is expected to remain subdued given the attractive returns achievable in 1st lien, but for those subordinated loans being issued, this part of the market should be targeting mid-to-high-teens gross returns (i.e. close to equity returns).

Figure 2: Mid-Market Debt Fund (MDF) Discount Spreads vs ELLI 3yr Discount Spread B3

3Source: Bloomberg as at 10 January 2024

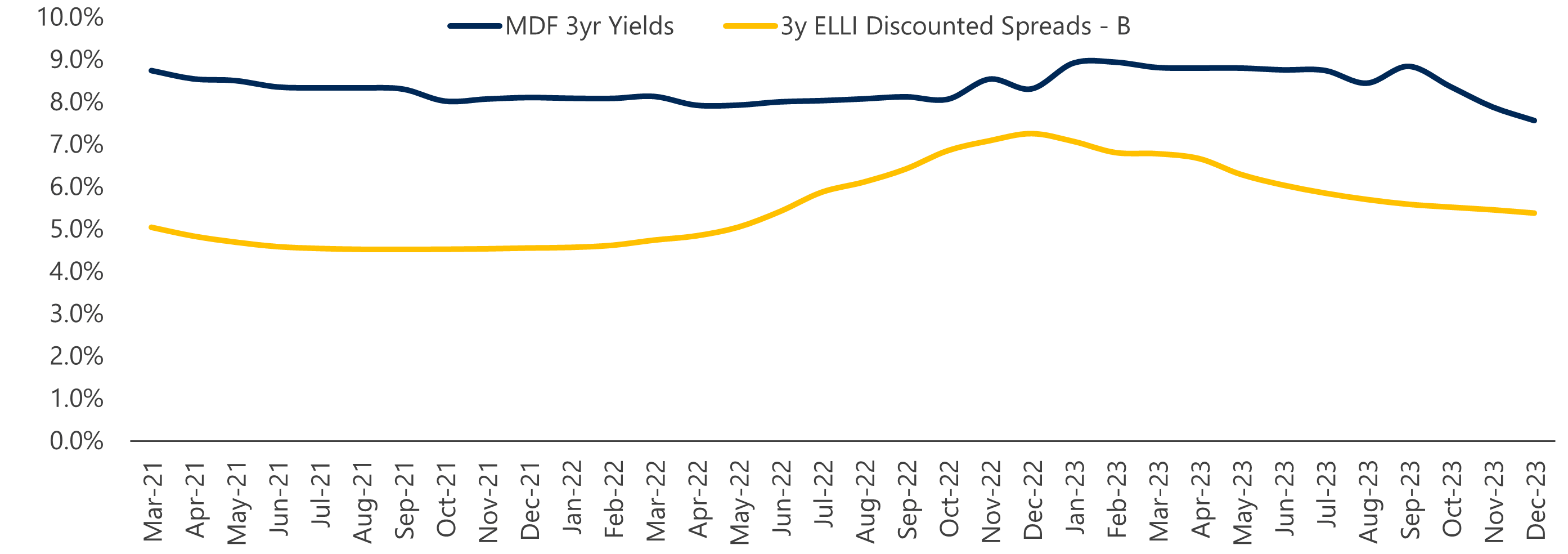

Looking back over the last three years since the Covid pandemic, the direct lending market has been exposed to a number of shocks including the Ukrainian crisis, a high inflation macroenvironment and a challenging backdrop for many businesses. In spite of this, Direct Lending yields have remained robust. The graph above shows the premium to syndicated loans. The graph below shows how High Yield has suffered in a market when floating rate loans have generated attractive returns.

Figure 3: Bloomberg Pan-European High Yield TR Index, Returns vs. 2021 YE4

4Source: 9fin Private Credit Q3 2023 Review

3. Increasing market share and the arrival of the clubbed direct lending trend in Europe:

We expect 2024 to see a continuation of the new trend of club direct lending deals, particularly for jumbo transactions (€1bn+ debt packages). These financings would have typically sourced liquidity from the CLO or broadly syndicated market, however, 2023 was a year where the high yield (see chart below) and syndicated leveraged loan markets saw limited stability.

Therefore PE-backed M&A accessed the direct lending market in club format for larger financings such as a €1.5bn financing for Constantia or a €4.5bn package for Adevinta. According to 9fin4, Q3 2023 featured six deals worth €1bn or more vs just two in H1 2023. This feature mirrors the US direct lending market which has for some time been more of a club financing space when it comes to larger tranches and we expect this part of the market to continue to grow as private equity sponsors continue to value the speed of execution, availability of capital and lower volatility of the direct lending market.

We think mid-market deals will continue to be single lender, dominated by the incumbent sourcing in the regional markets but jumbo deals will increasingly migrate from the public markets to private direct lending clubs.

Figure 4: European High Yield Issuances, in €B, Trailing Twelve Months5

5Source: PitchBook / LCD as of 11 January 2024

4. Deal volumes:

We believe overall M&A activity in 2024 will be higher than 2023 but remain below 2019 and 2021 peaks. We saw a notable uptick in volumes in Q4 –23, where Pemberton signed 9 investments in 3 months and see this as a lead indicator of what is to come in 2024.

We believe that seller price expectations are becoming more reasonable and acquisition structures are adapting to the new environment with (1) earn out structures bridging the bid-offer in EV, (2) lower leverage, and (3) a more sensible expectation around interest rates and inflation. Further, we believe that public to private transaction volumes will also increase in 2024, as they have done through 2023.

With the slow down in M&A volumes in 2023 we have seen a modest extension to hold periods of some assets, but we would expect realisations to increase in 2024 on the back of higher year over year M&A volumes.

5. Economic outlook:

The 2024 economic outlook is for low levels of growth in Europe and the US. Whilst different countries and sectors within these geographies can have very different prospects, the general backdrop is projected to be relatively flat, with higher interest rates being used to control inflation.

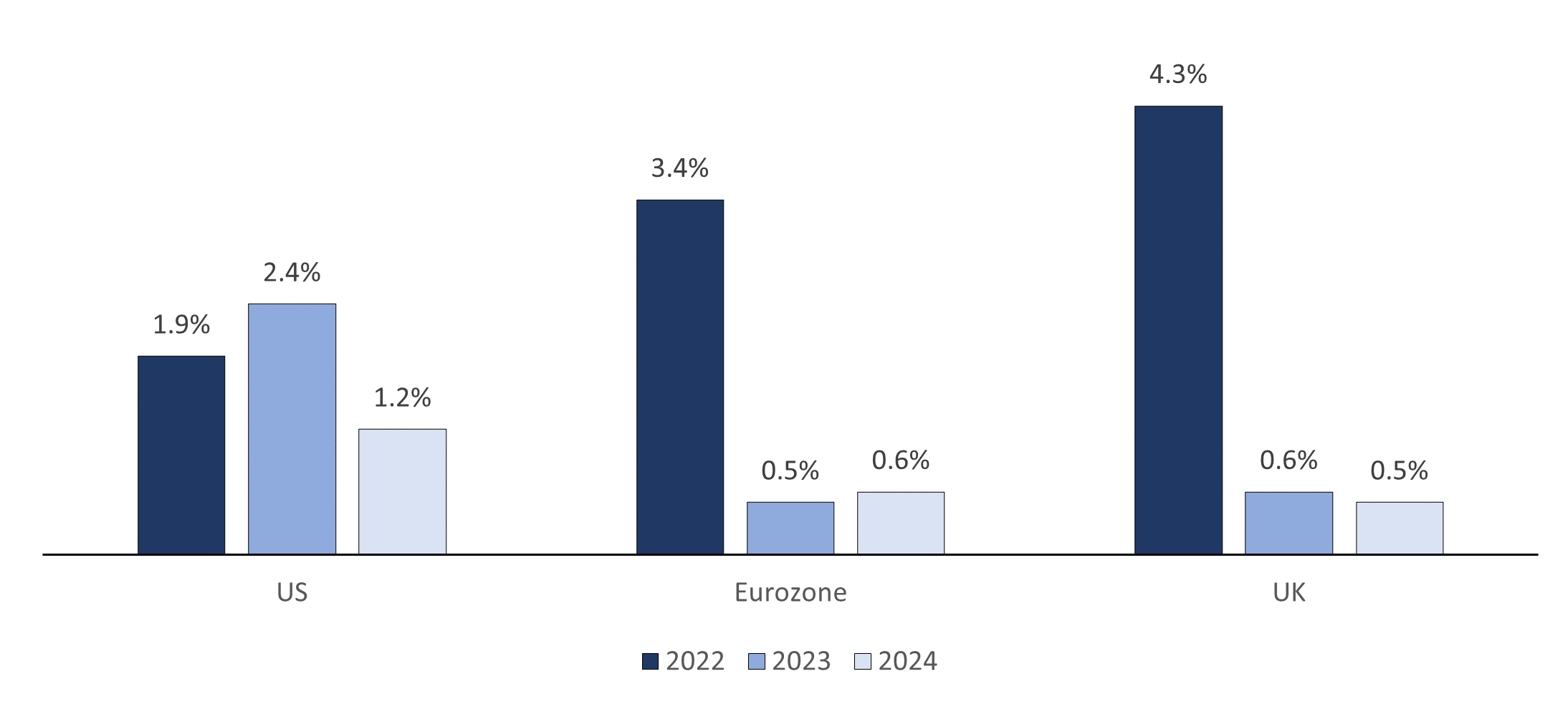

Figure 5: Real GDP % YoY for selected economies6

6Source: Oxford Economics – Global Macro Themes and Asset Views Chartbook as of Dec 2023

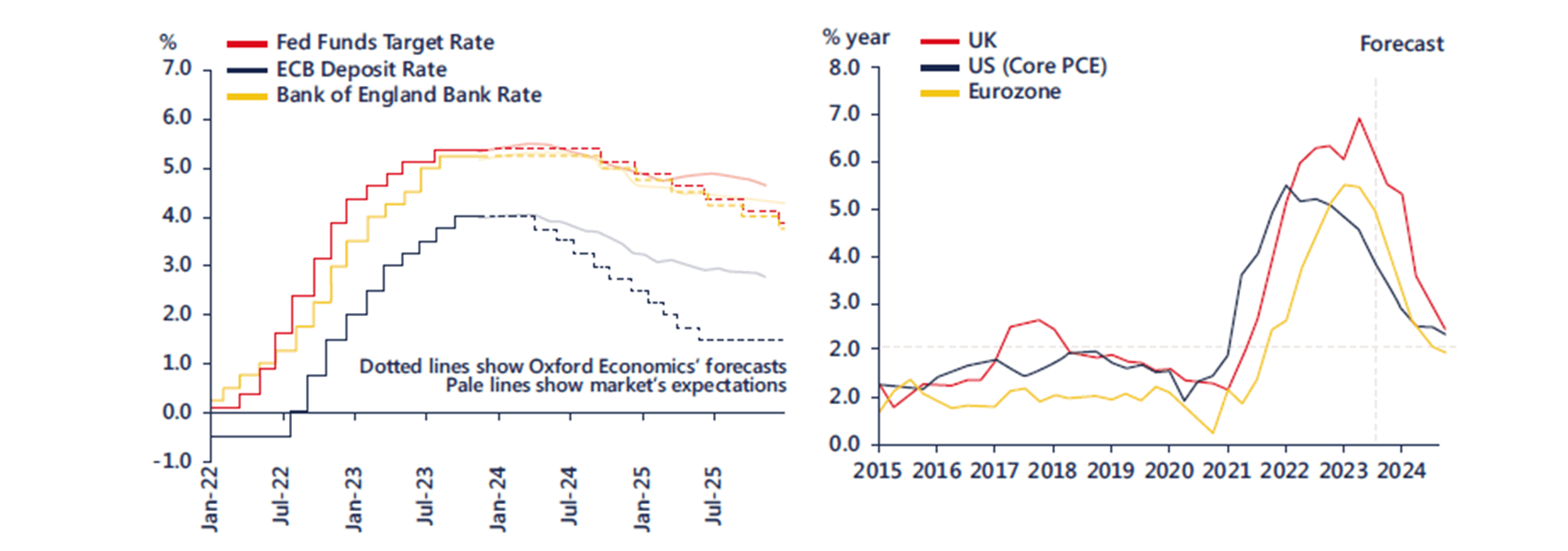

The softer economic backdrop and easing inflationary pressure create a narrative for rate cuts in 2024. However, it should be noted that base rate cuts will only be delivered once bad news such as job losses and a general cooling of inflation start to bite.

Figure 6: Policy rates and CPI forecast7

Figure 7: Inflation YoY for selected economies8

7Source: Oxford Economics – Research Briefing as of 15 Nov 2023

8Source: Oxford Economics – Global Macro Themes and Asset Views Chartbook as of Dec 2023

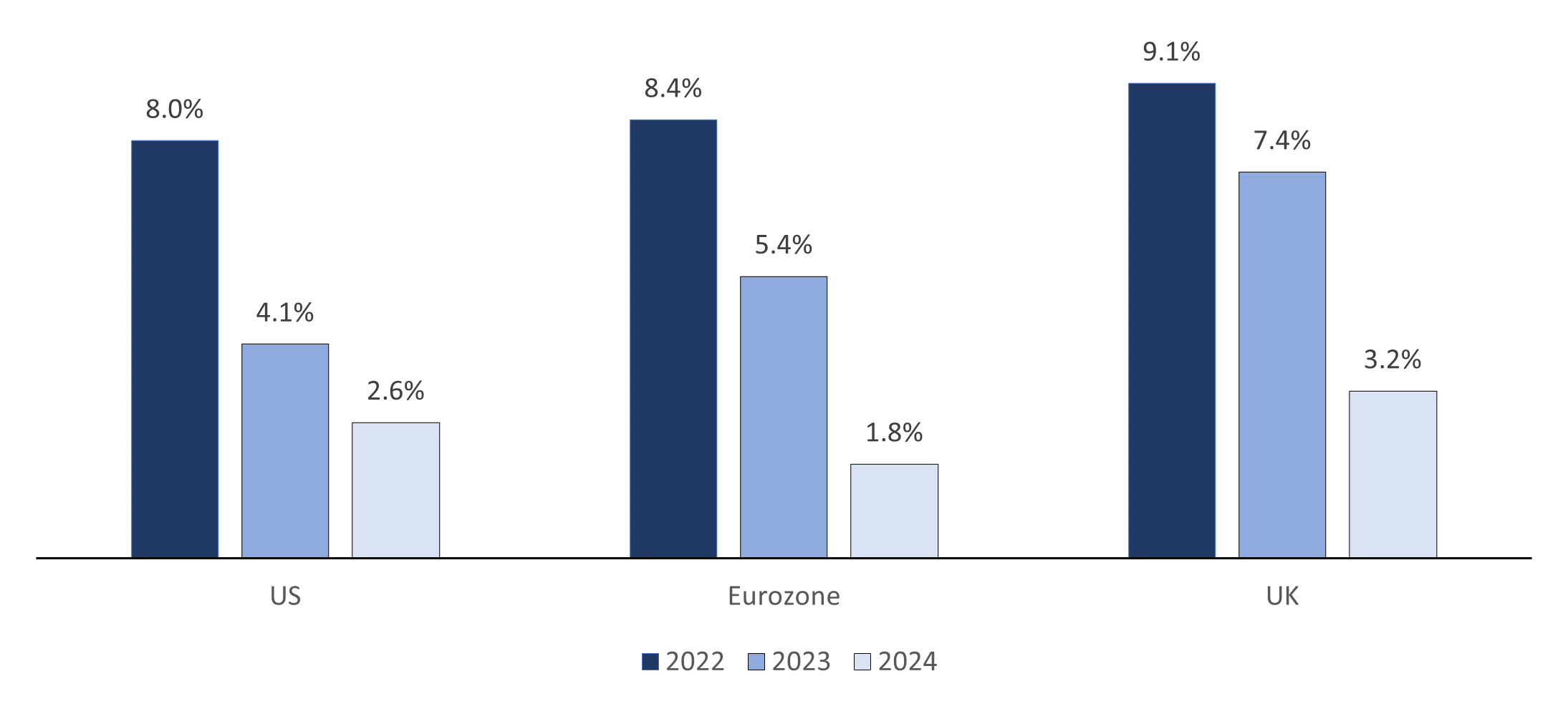

6. Defaults:

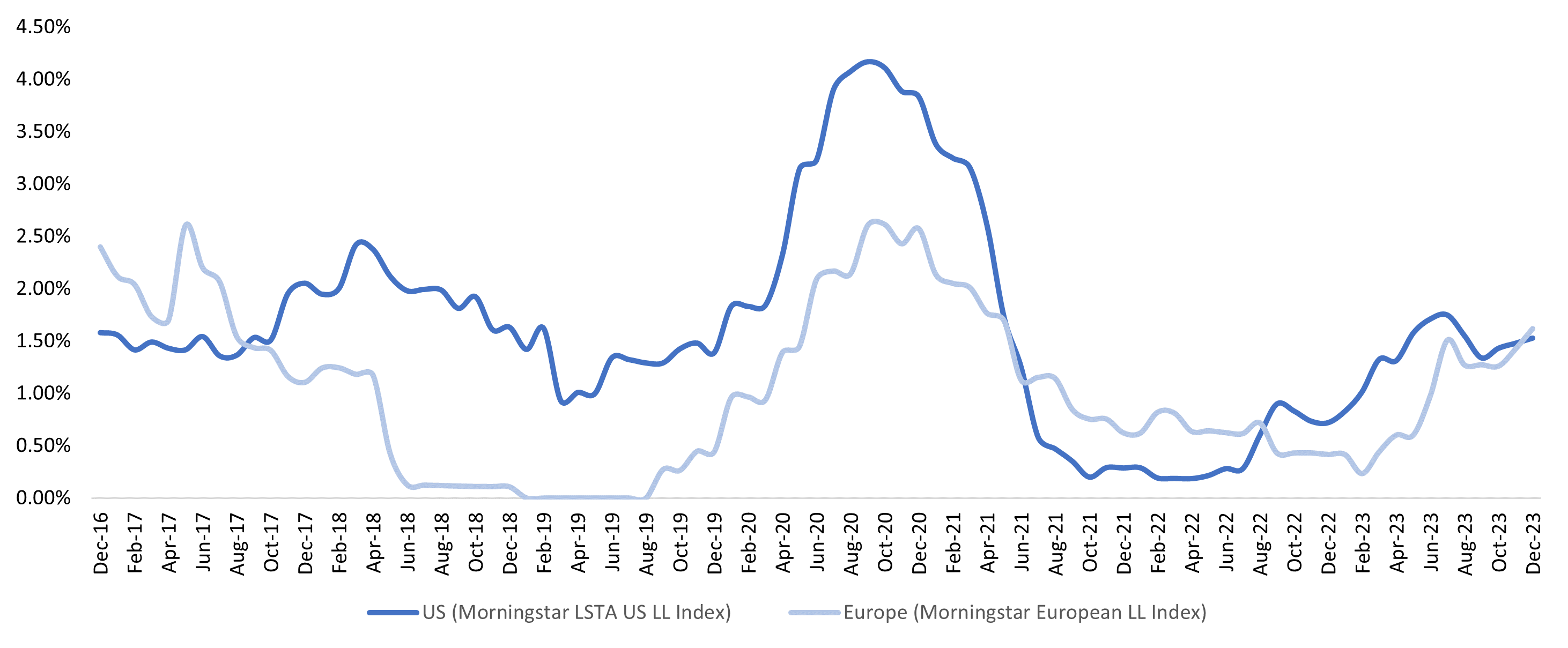

In the first half of 2023, we continued to see strong performance with consistently low default rates in Europe, while the US market experienced higher volatility. Historically, US loan default rates tend to be higher, as evidenced by the average US LDR at 1.62% and the European LDR at 1.02%. In the second half of the year the tougher interest rate environment started to take its toll on European default rates.

Figure 8: US and Europe Trailing Twelve Months (TTM) Loan Default Rates (Principal amount)9

9Source: Morningstar as at Dec-23

10Source: Moody’s 2024 Outlook as of 16 Nov 2023

High interest rates will persist in the short- to medium-term and continue to weigh on corporate earnings, gradually eroding interest cover and free cash flow generation. Many companies continue to benefit from substantial fixed-rate debt though, which mitigates the immediate pressure on default rates. Default rates are projected to remain elevated for an extended period, peaking at 3.7% in Europe in Q1 (compared to 4.7% during the GFC).10

As a result of the higher probability of defaults, the assessment of LGDs (loss given default) will be key to investment decisions. In other words, the ability to recover losses from a borrower in the event of a default will be heavily emphasised and restructuring and recovery expertise within asset managers will continue to be of great importance.

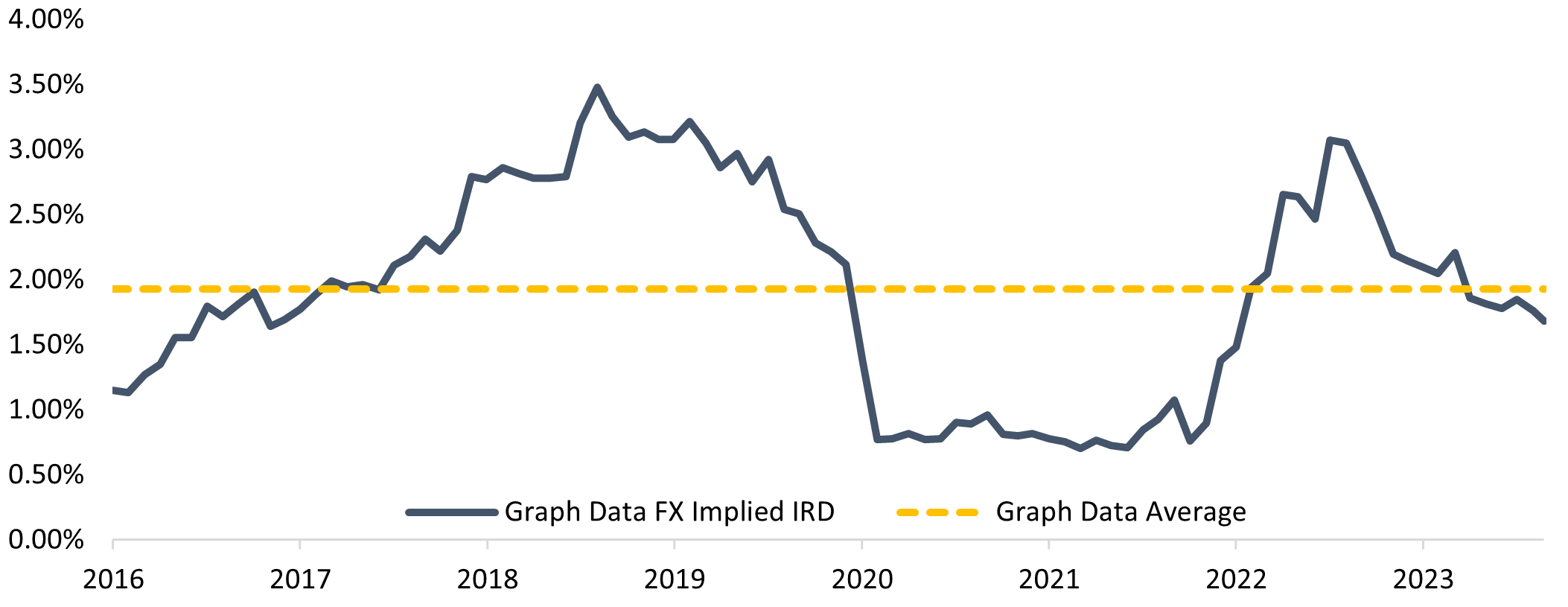

7. US dollar returns for investors into European Direct Lending:

We believe that USD investors will continue to benefit from a significant uplift in returns through 2024 when they invest in European Direct Lending. Current FX forwards are showing a 1.60 –1.65%11 uplift over 1 –3 years, taking an illustrative 10% net return in EUR to a 11.6% net return in USD if hedging strategies are executed smoothly.

This is in-line with the ca. 2% uplift that we have seen in recent years.

Figure 9: EUR USD FX Uplift – 3month forwards12

11Source: Record Financial Group as of 4 January 2024

12Source: Record Financial Group as of 21 November 2023

Conclusion

2024 will be a year of opportunity for European Direct Lending. A stabilisation in base rate levels will help market participants accept and adjust to the new normal of lower exit multiples, lower leverage and more equity-heavy capital structures. Q1 2024 carries a lot of positive momentum from the year-end rally in 2023, and with a potential tapering in sight, we expect sponsor-backed M&A activity to increase throughout the year versus 2023. As a result, direct lending solutions will be in high demand in 2024 and will continue to offer very attractive returns at enticing all-in yield levels.

Recent research articles

24th July 2024

Sustainable Investing Report 2023/24

17th July 2024

Mid Year Review 2024

5th April 2024

Significant Risk Transfer (SRT) Chronicles 2024

28th February 2024

NAVigator Series: A Hypothetical Performance Analysis

21st February 2024

NAV Financing: Evolution within Fund Financing

7th February 2024

Building Resilient and Diversified Income Streams from Private Debt

6th March 2023