Announcement

Pemberton Announces First Close at Over US$1Bn of Investible Capital for its New NAV Strategic Financing Strategy

Pemberton Asset Management (“Pemberton”), a leading European private credit manager, today announces the first close of its new NAV Strategic Financing strategy (“the Strategy”) at over $1bn of investible capital.

The Strategy provides financing solutions to private equity firms predicated on the underlying value of their performing investment portfolios, secured investment from Abu Dhabi Investment Authority (ADIA) as anchor investor, Legal & General and other leading investors.

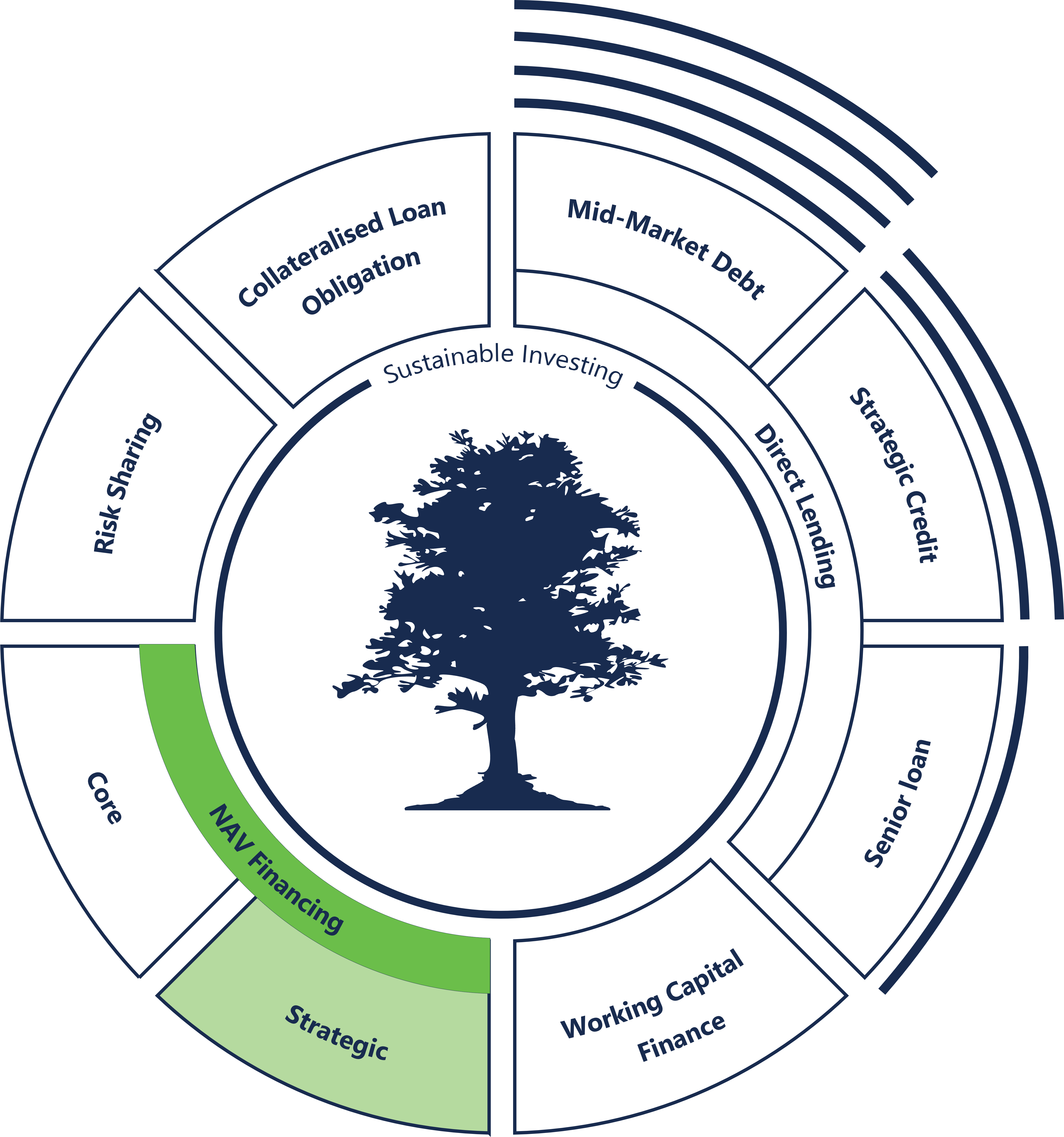

NAV Strategic Financing capitalises on the growth of the private equity fund finance market to provide non-dilutive strategic capital solutions to private equity GPs and funds. The asset class provides flexible financing including senior loans and preferred equity against concentrated collateral portfolios or targeting higher loan-to-value facilities with higher returns.

Primarily focused on enabling private equity firms to diversify, grow and increase commitments to their funds, the Strategy also provides capital for their portfolio companies for accretive and defensive application such as bolt-on acquisitions.

The Strategy is a natural extension of Pemberton’s market-leading direct lending platform, which currently offers lending solutions for individual assets, and enables Pemberton to offer a broader range of products to its private equity buyout community. It leverages the breadth and the depth of Pemberton’s well-established origination, investment and credit platform. As a flexible financing tool supporting PE sponsors post the investment stage of a fund, Pemberton can also service sponsors throughout the life cycle of the fund.

Further to announcing ADIA’s anchor investment in June, this represents a significant first close for the Strategy. NAV financing is a credible and worthy financing option that can bring benefits to investors, private equity firms and the portfolio companies that all form part of this robust and active market. This milestone represents the growing attractiveness of the asset class and is a testament to the team.

-Thomas Doyle, Partner and Head of Strategic Financing at Pemberton

Recent news articles

27th February 2025

Pemberton Asset Management Supports Andera Partners’ Buyout of Ayming

23rd January 2025