CLOs

Pemberton’s CLO strategy invests in publicly rated, broadly syndicated leveraged loans, which are typically used to fund sponsor driven or corporate M&A activity.

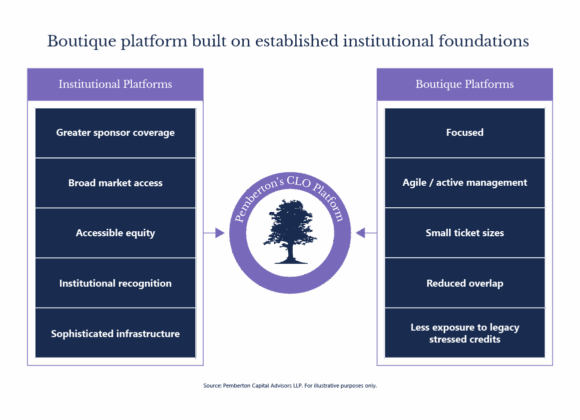

Pemberton’s CLO strategy invests in publicly rated, broadly syndicated leveraged loans, which are typically used to fund sponsor driven or corporate M&A activity. Such loans are originated by major arranging banks and held by various market participants. As a result, they are also liquid with an active secondary market. CLOs have proven to be resilient investment vehicles through multiple cycles delivering attractive risk adjusted returns to note holders.

Data as at 31st December 2024. Excludes warehoused exposure associated with future CLO issuance.

Pemberton’s CLO investment philosophy is predicated on the construction of highly diversified credit portfolios utilising a 3D approach focusing on fundamental analysis techniques and adopting a relative value approach for portfolio optimisation purposes.

Pemberton closed its first CLO (Indigo Credit Management I DAC) in November 2023 and second CLO (Indigo Credit Management II DAC) in December 2024. CLOs complement Pemberton’s Direct Lending and Working Capital Solutions strategies, offering investors access to a further credit product to suit their investment and allocation needs.

Consistent with Pemberton’s ethical principles, Pemberton’s CLOs incorporate the latest thinking in sustainable investment policies and are built into investment decision making.

For more information, visit our News page, or click on our latest article.

Click here for an overview of Pemberton’s Strategies.

For further information or if you have a specific query, please get in touch.

Contact – お問い合わせ